Hello,

I have configured the reverse charge VAT setup in GP which appears to be fairly straight forward. I have followed the instructions in both the VAT Daybook documentation and on the few articles I can find but the reverse charge VAT is not added to the Purchase Order Tax Summary Entry window. The positive tax is correctly applied to the line item and the summary when entering the PO line items. See the steps below that were completed to configure the reverse charge VAT in GP. Any thoughts on what I am missing here will be greatly appreciated. Thank you.

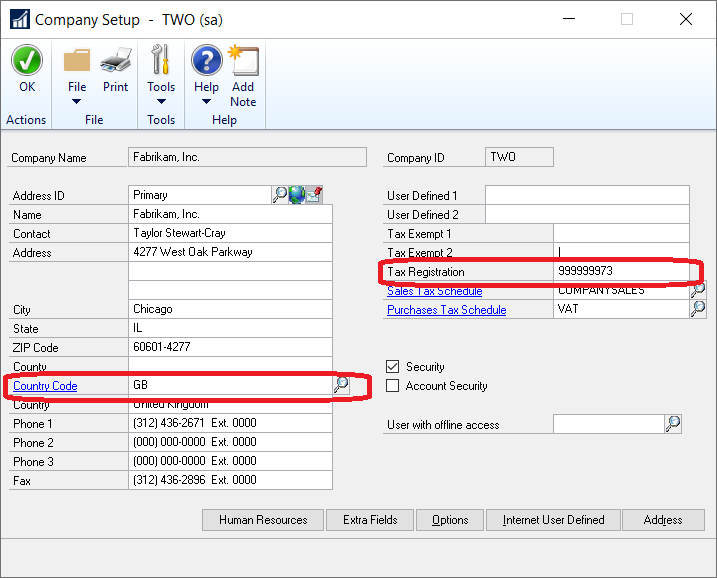

Enter the tax registration number and correct Country Code (GB) on the Company Setup window.

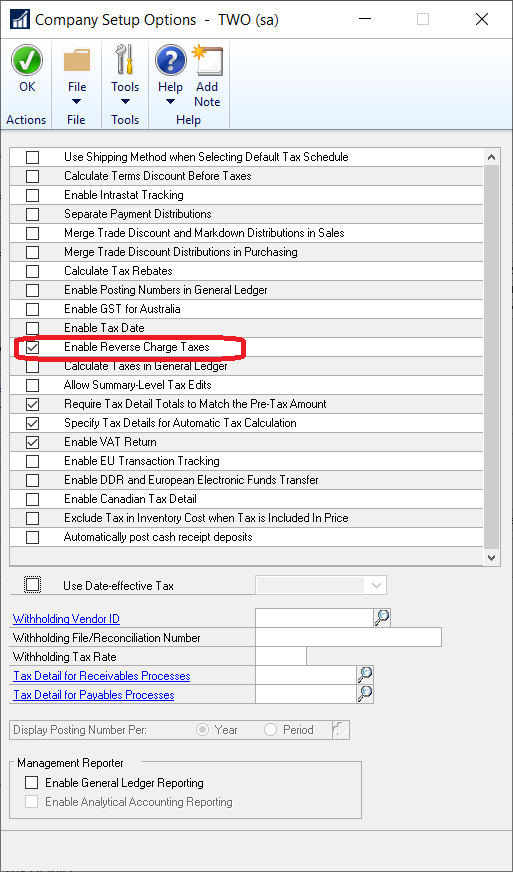

Select Enable Reverse Charge Tax option on the Company Setup Options window.

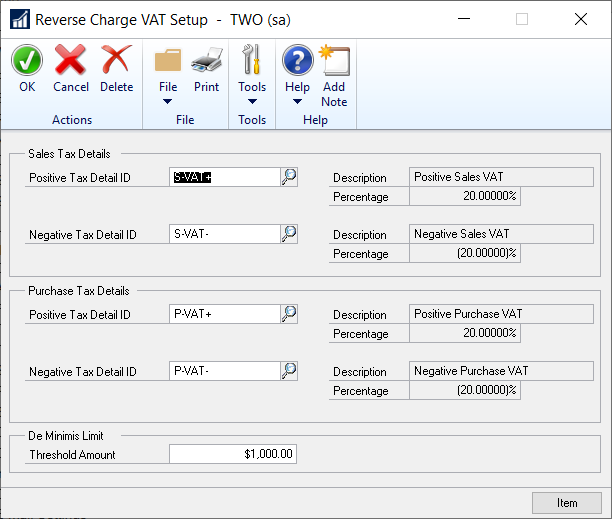

Setup the positive and negative VAT tax details and associate them in the Reverse Charge VAT setup window.

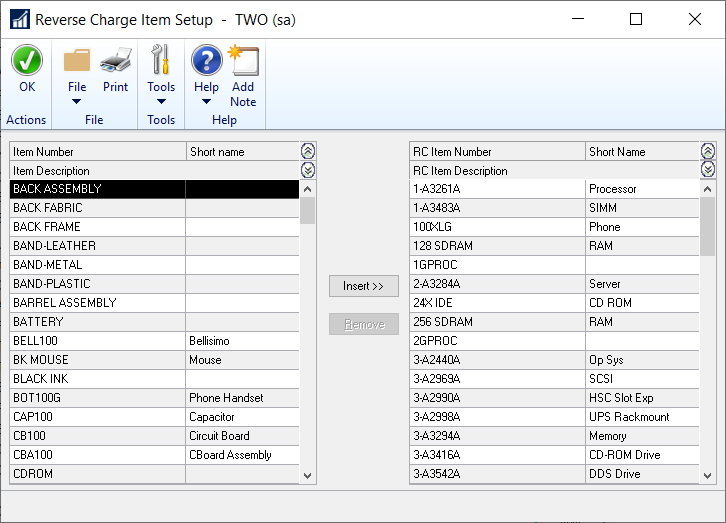

Select the items that are subject to reverse

charge in the Reverse Charge Item Setup

window.

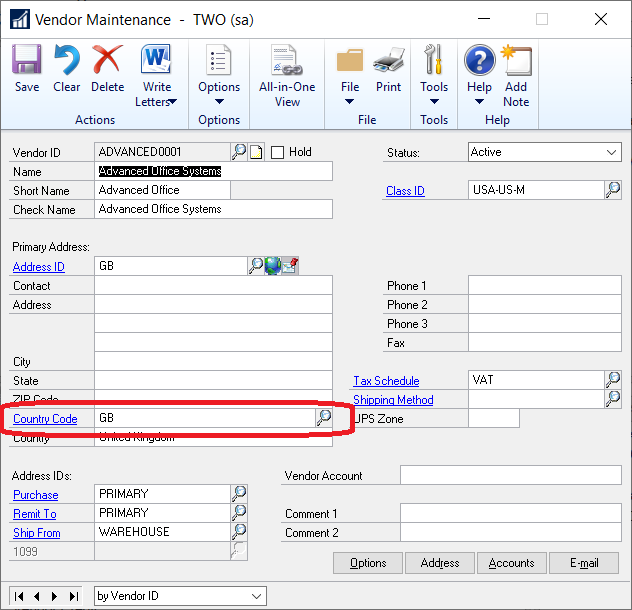

Select GB as the country code for the

vendor’s primary address in the Creditor

Address Maintenance window for the

vendors eligible for reverse charge VAT.

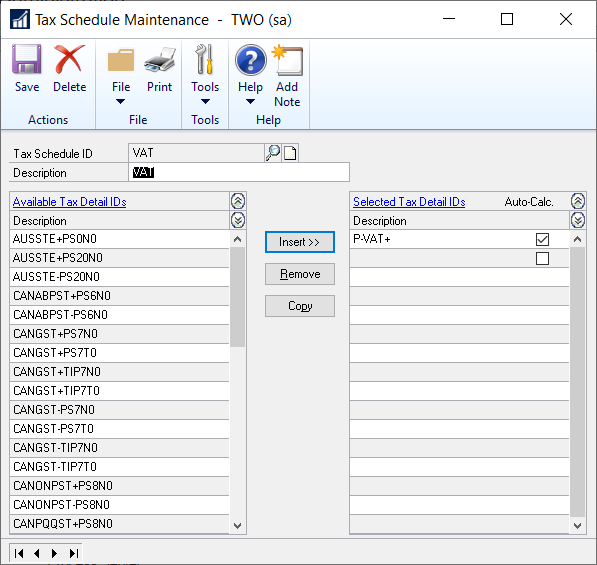

Be sure that the positive VAT detail ID is

included in the tax schedule that will be

used for the reverse charge item during

transaction entry.