Hello All,

I've searched to see if anyone else had this issue but I was not able to locate a similar issue.

Recently I began looking into fixed asset items that arose from when AX was implemented. It's a implementation problem that needs reclass.

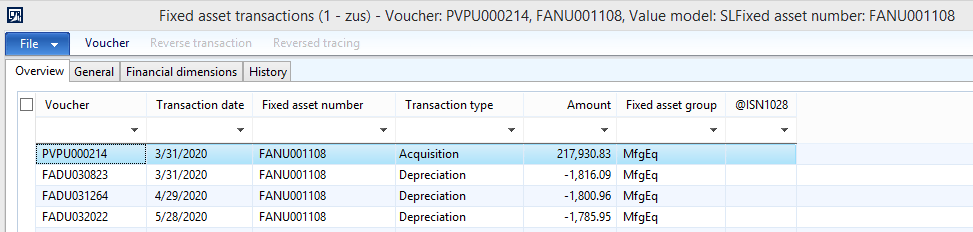

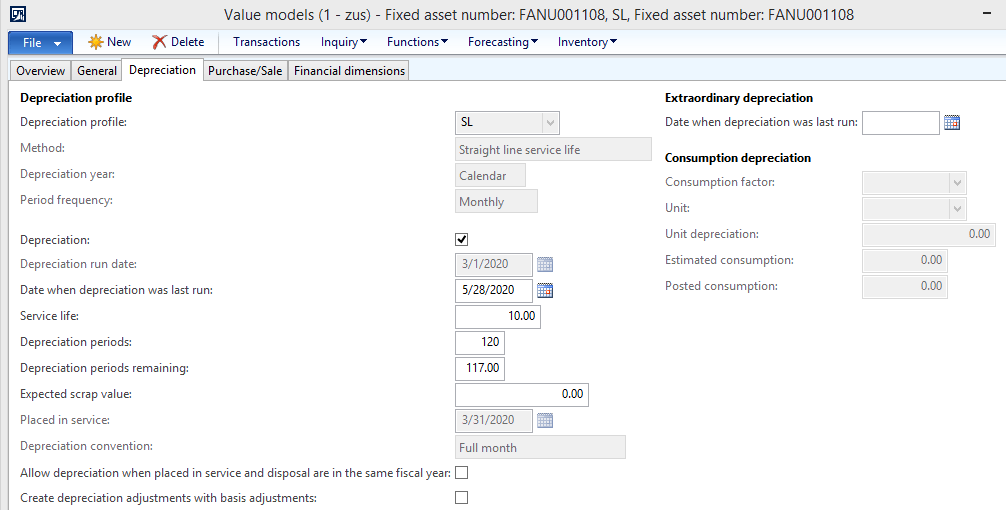

However, one issue I noticed is that on new assets, depreciation is supposed to be straight line. But with each month, it is subtracting depreciation from the prior month and then calculating depreciation straight line again.

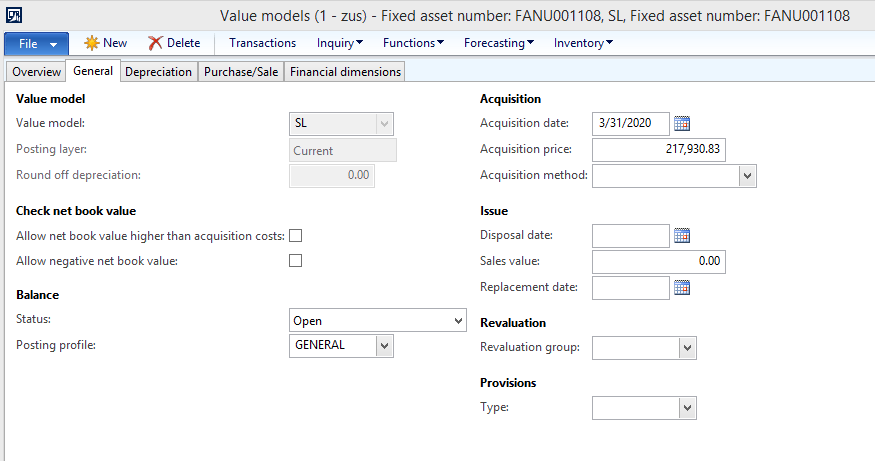

I'm not sure if the set up is incorrect in the depreciation book or the depreciation profile or the asset itself.

Any ideas would be helpful.

Thank you

Christine