Hello experts,

The scenario is quite simple: The Product receipt was posted in a past date, and now that the inventory is closed, we ought to cancel this PO. We are unable to do so because of the posted Product receipt.

Any suggestions? I would highly appreciate it if the solution doesn't involve the cancelation of the Inventory Closing.

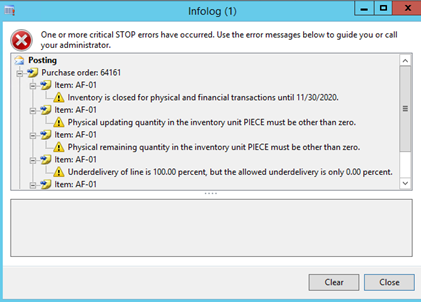

The warning reads:

"Inventory is closed for physical and financial transactions until xx/xx/xxxx"