Hello all. I'm not seeing the results I would expect after running the Settle and Post Sales Tax process.

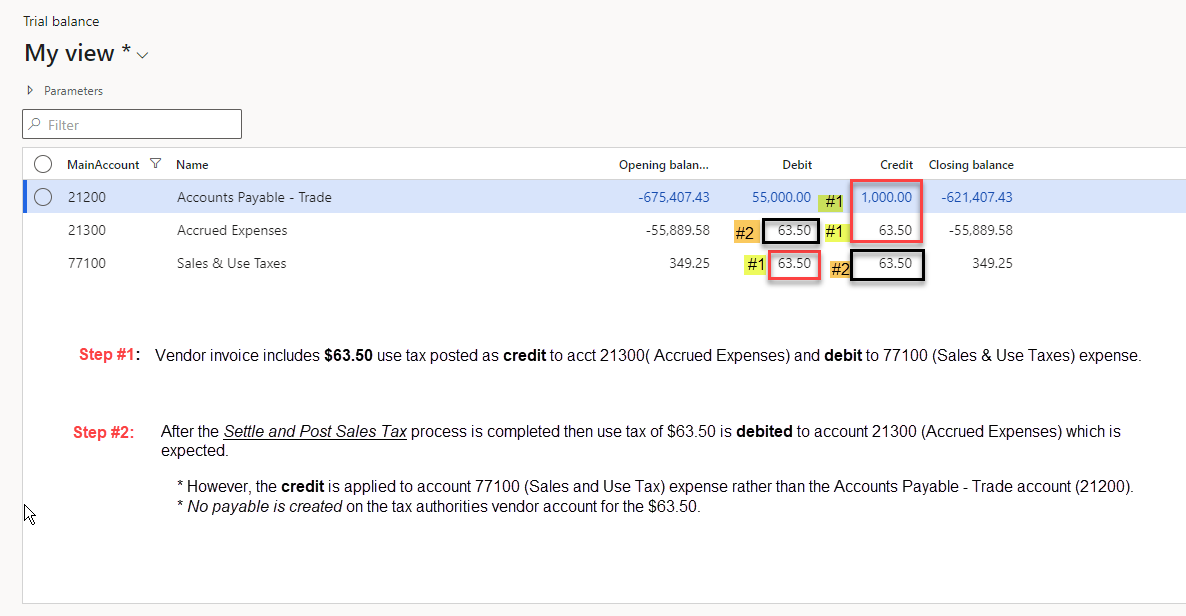

A. I entered a vendor invoice for $1,000 and referenced a sales tax group that calculates 6.35% Use tax of $63.50.

Posting results: 63.50 credit to balance sheet account for Accrued Expenses ==> debit is to expense account for Sales and Use Taxes.

B. After the Settle and Post Sales Tax process was completed,

Posting results: the Accrued Expenses balance sheet account to was a debited for 63.50 (which is what I would expect). However, the credit was posted against the expense account for Sales and Use Taxes and not the Accounts Payable Trade balance sheet account (which is what I would have expected). Also as a result no vendor invoice was created for the tax authority.

Any advice on how to configure to have use tax on vendor transactions clear out of Accrued Expenses and post to AP Trade will be appreciated.

Thanks all,

Barry

Below are screens related to this scenario.

Trial Balance

GL Parameters

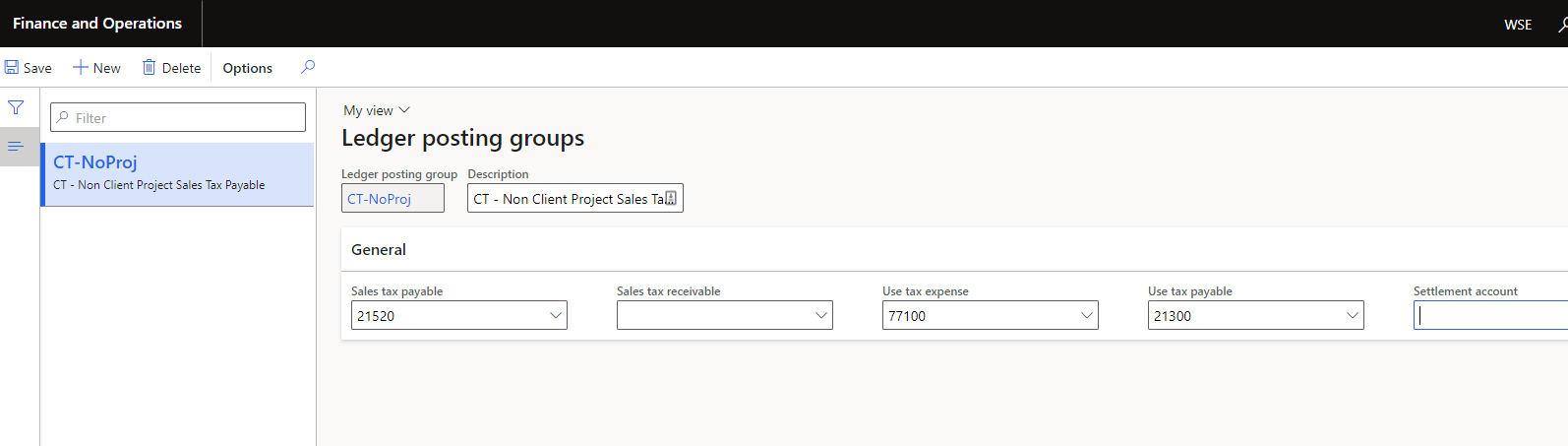

Ledger Posting Group

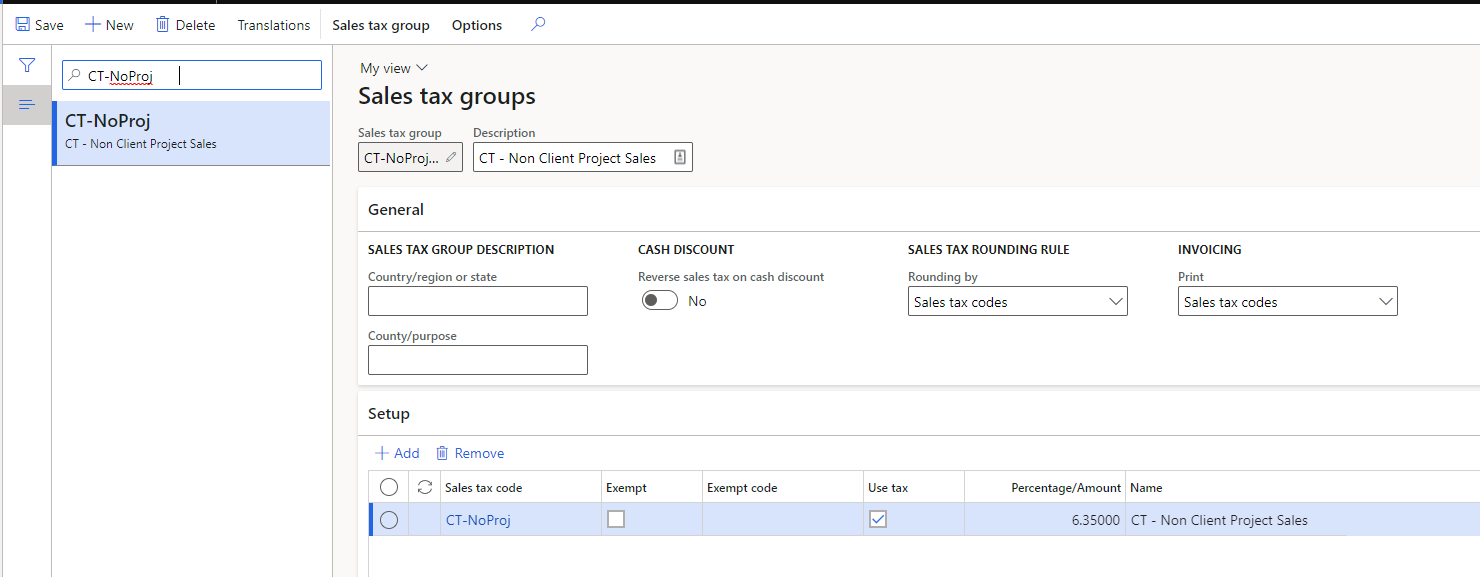

Sales Tax Group