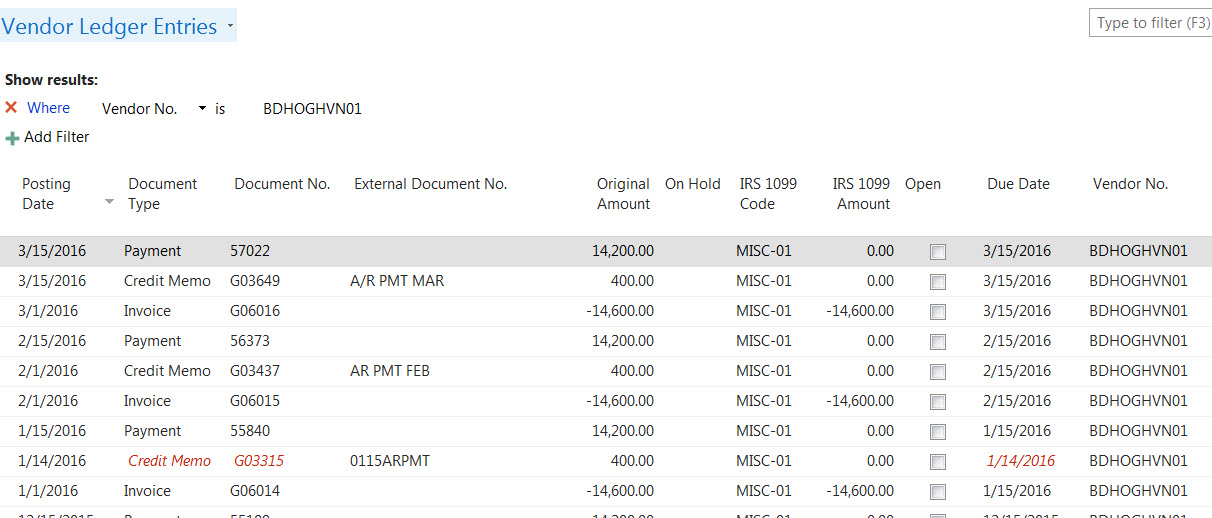

Is there a reason why my 1099 report is not showing the correct amount? If you look at the screen shot of my entries for B & D, I have deducted 400.00 from them each month and currently when I run the report, it is off by 400. 1099 Report is showing 43400.00 and it should be 43800.00. Thanks

This is the way I run the 1099 report

![]()

*This post is locked for comments

I have the same question (0)