Hi All,

I want to know the working of GST transaction- Detail report. Two journals are showing under two different tax code while on journal line have selected same gst code.

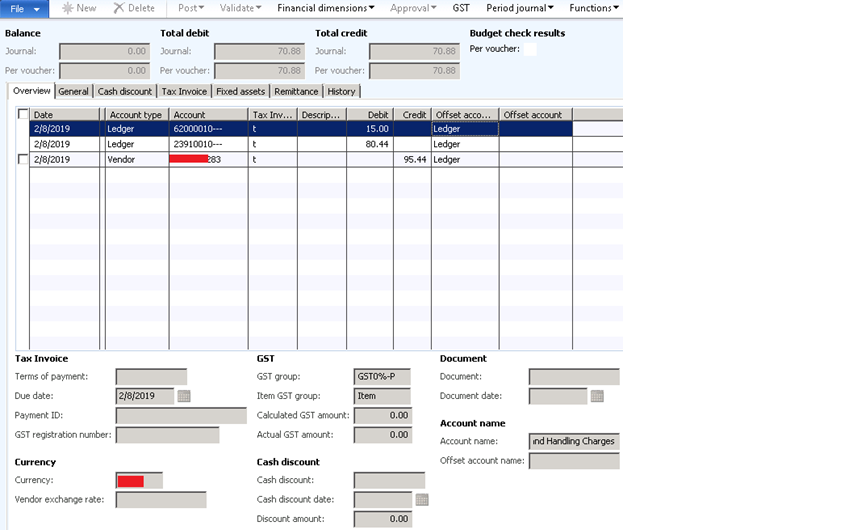

I have two journal – Case 1: Tax invoice journal(Total 3 lines 1- Vendor,1-GST input account,1-Freight and Handling Charges account ) I have selected the GST group(NA) & GST code(NA - 0 % rate) on line where Account type =Ledger & Account no= GST input account(Accnt no -23910010). I have selected other GST group (GST0-P) and GST code- NA for other account which is Freight and Handling Charges account.

GST Data for GST input account line(Accnt no - 23910010) :-

GST data for non GST account :-

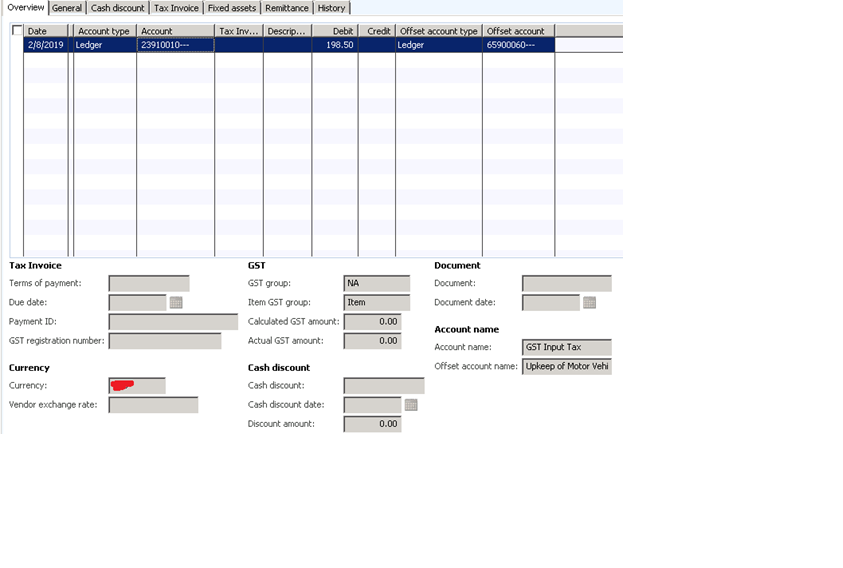

Case 2: Tax invoice journal (Single line with account type as Ledger)

I have selected the GST group(NA) & GST code(NA - 0 % rate) on line where Account type =Ledger & Account no= GST input account.

GST Data:-

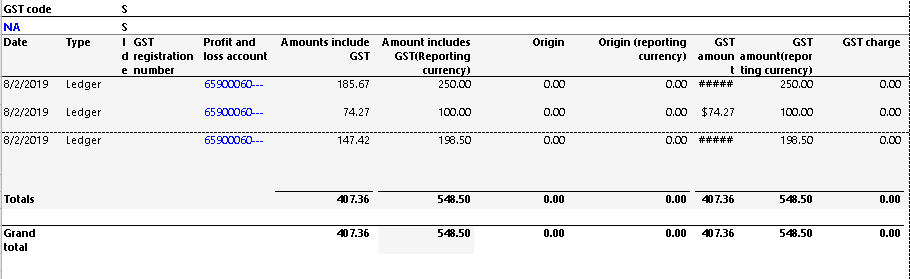

So ideally both the journals should show me 0 GST amount and when I run the tax transaction- detail report then it should show under GST code = NA

When I run the report , I observed the single line Journal is showing under GST code- NA while multiline Tax invoice journal is showing under (GST0-P ..(Rate is 0% only))

Report output-

1.Multiline journal is showing under GST code GST0-P :-

2.Single line journal showing under NA GST code:-

Thanks,

Shri