I am encountering an issue with the Project "Actual Costs" calculations that are not including the calculated sales tax amounts. The cost commitments are recognizing the tax amounts, but the actual cost calculations are not. US Tax rules are enabled.

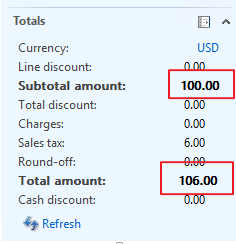

Simple 1 line PO created for $100, with a 6% sales tax. PO line is for a Procurement Category with no Item number:

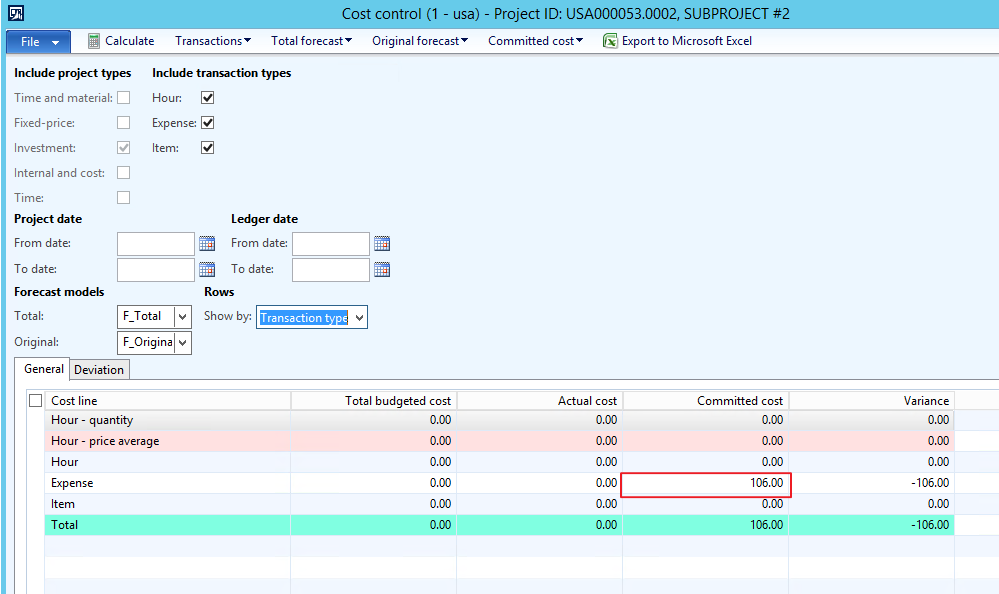

After confirmation of the PO, the committed costs on the Cost Control Inquiry for the project shows $106.00 as follows:

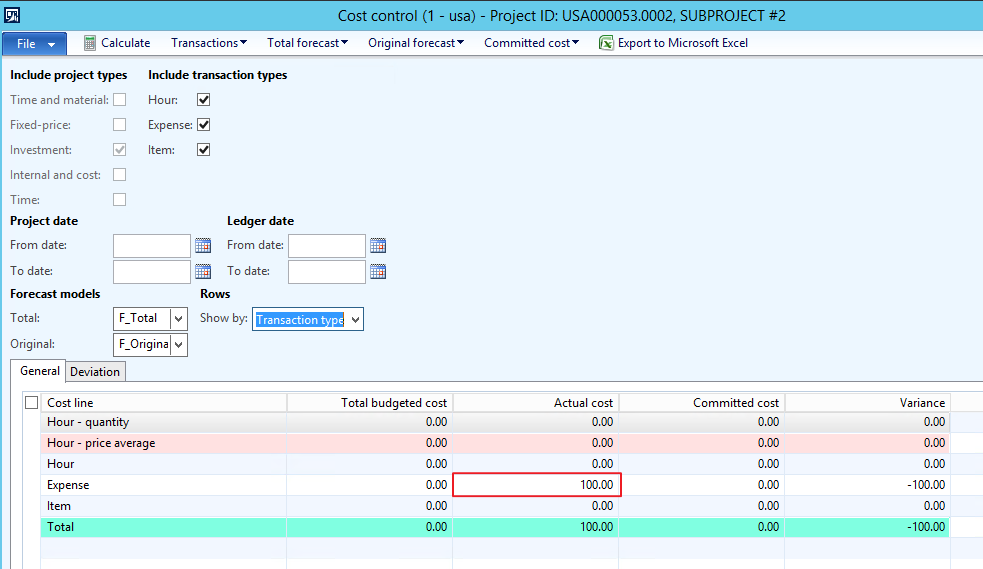

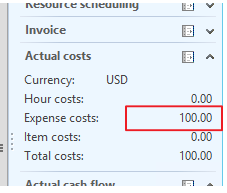

After invoicing the PO in full, the committed cost is relieved. The amount is now considered an Actual cost, but omitted the $6.00 sales tax amount. Same calculation is shown on the Actual costs FactBox for the project. Any reason why?

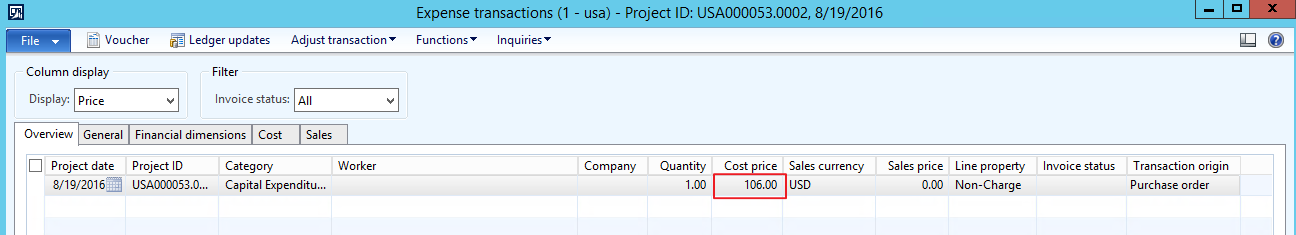

When looking at the Project expense transaction, it shows a cost price that includes the tax for the full $106.00:

Smells to me like a bug. Any reason why the tax amount would be omitted on the "Actual" cost calculations?