Hi,

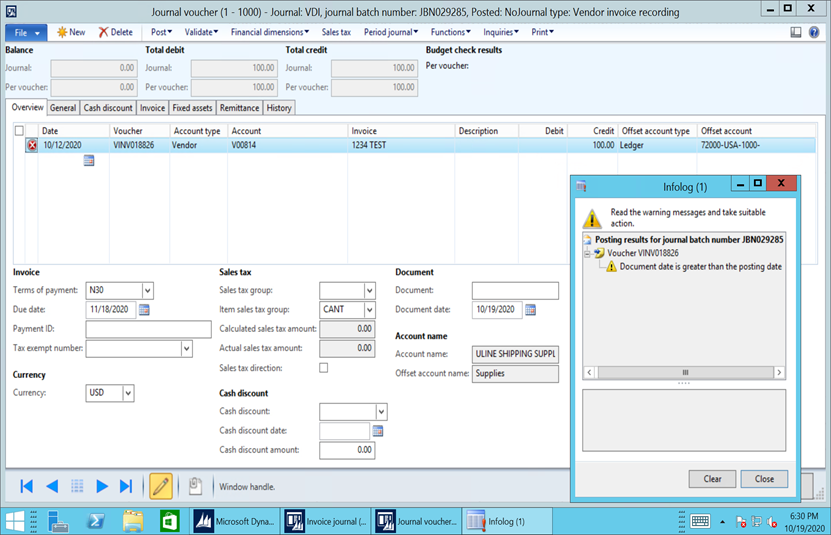

screen shot :

i dont' know if you can see my screen shot clearly.

However, in this I put a Document date of 10/19/20 , which is a later date, than what I put of the DATE (Posting date) of 10/12/20.

When I go to Validate, I get a warning message that says " Document date is greater than the posting date" .

What is the purpose of this warning, in Accrual GAAP accounting?

I do not want to change invoice dates (doc date) because those dates are important for aging, and terms of payment due dates among other reasons.

Why do I get this warning?

If a previous accounting period is open, to allow posts, this message still appears.

It will only allow entry of invoice that are dated the same date or before , from the posting date.

My company has many invoices that are for services that occurred a week or longer before the invoice date. Mostly transportation shipping, and lab testing work.

The invoices will indicate the service dates on it, and I want to book it to the correct accounting period, but I can't.

I would understand if the warning was "the period is closed", as I know there are cut off dates for posting to previous period.

But no, the warning is saying that I can not post because of the document date being after the posting date.

This is in the Accounts Payable > Invoices > Invoice Journal

VDI = Vendor Invoice Recording Journal > Journal Batch > Line Item recording.

I Can not validate, or post without changing the invoice Document Date.

i am not talking about supplies orders. Because that is basic, if something is shipped to us, that we record it on the point we receive it at our location.

Which is typically the invoice date or later. In that case, there is no problems with trying to post a document earlier than the invoice date.

The concern is with services that were to our benefit/ took place prior to the invoice date.

Any guidance would be helpful.

Dynamics AX