Hi,

I need to process AP and AR payments in foreign currency and many questions come up.

1. In the case of AP, I create payments in D365 and send the files to the bank. So the transactions in D365 are generated before we can see them in our bank statements. As I don't know which exchange rate the bank is going to apply I guess I can't post the payment journal until I see it in the bank and change manually the exchange rate so the amount that I will deduct from my D365 bank account match the amounts that I see on my bank statement. Can you confirm that this is the best practice in this scenario?

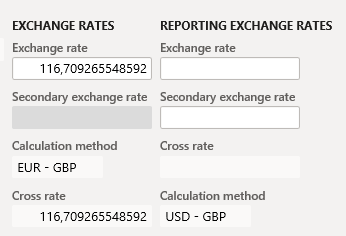

2. In case of customers, many times we will see the receipts in our bank statements before we create the payment proposal in D365. So we will calculate which exchange rate the bank has applied and put it manually on the "exchange rate" field under "exchange rates". This does not make much sense to me. It would make more sense that I manually inform the amount the bank has deducted and the exchange rate gets calculated accordingly. Am I understanding this correctly?

When would the "secondary exchange rate" and the "cross rate" be active?

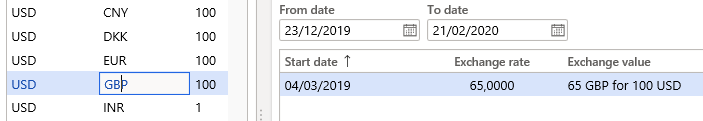

Also, why are the reporting exchange rates empty? There's a exchange rate informed in the system for that pair: