Hey André,

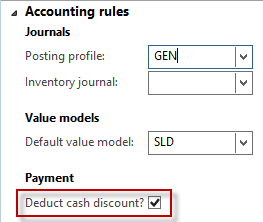

I agree with you that cash discount is a seperate posting, but together with the setup in FA parameters, it gets posted automatically on the fixed asset (subledger account and G/L account) at time of the payment (with payment voucher), when it's connected to the invoice.

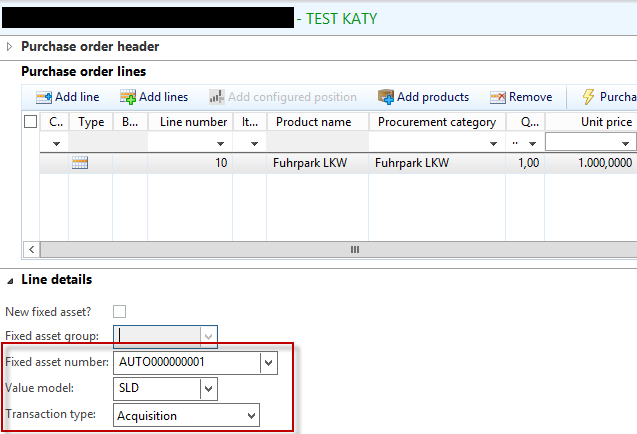

So when I create a new fixed asset and connect it with the PO, the acquisition gets posted automatically with posting the invoice via PO.

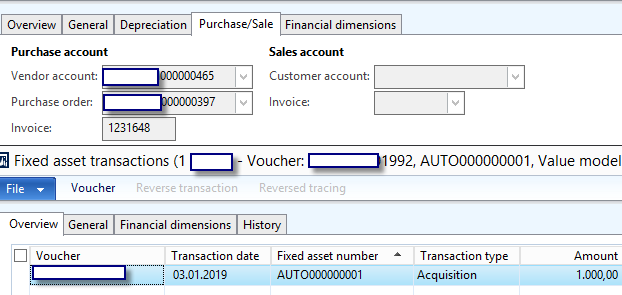

So far so good - I posted invoice and got the connection to the PO and the vendor invoice on the FA, AX generated automatically fixed asset transaction "acquisition".

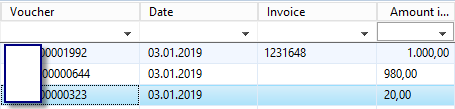

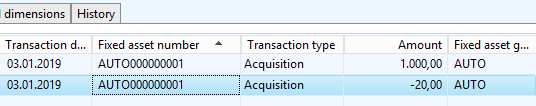

And now, if I post the payment to the invoice and let the system post the cash discount, it gets posted on the fixed asset as well (as a deduction of the acquisition) - automatically.

Here are the vendor transactions (invoice, payment, cash discount):

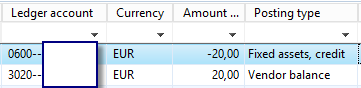

Settlement voucher (cash discount):

And the fixed asset transactions:

Sorry for the smallest screenshots ever, the quality was bad if I uploaded bigger ones....

The only postings I did were 1.) vendor invoice and 2.) vendor payment with automatic posting of cash discount

That's what I want. That the cash discount gets posted automatically on the FA when the payment is made and cash discount has been deducted.

From my understanding, this can just work, if the asset is connected with the vendor invoice (how else...). So that's why I'd like to connect it after posting the invoice, because at time of buying, as I said, I don't know, if it's going to be a fixed asset or not.

I hope you can understand what I'm talking about :)

Kind regards

Katy