Hi All

My client is based in India and have presented the following issue with how to raise a Payables Invoice in GP 2016 R2:

| Account Name |

Debit |

Credit |

| Professional Fees A/c Dr |

100000 |

|

| Transportation A/c Dr |

10000 |

|

| P- Input CGST 9% |

9000 |

|

| P- Input SGST 9% |

9000 |

|

| P- Input CGST 6% |

600 |

|

| P- Input SGST 6% |

600 |

|

| To 194 J @10% |

|

10000 |

| To 194 C @2% |

|

200 |

| To Vendor A/c |

|

119000 |

The professional Fees and Transportation are separate PURCH amounts the rest of the Debits are TAXES as well as the top two Credit amounts which are setup as individual tax details with a negative percentage and the last Credit is the PAY line.

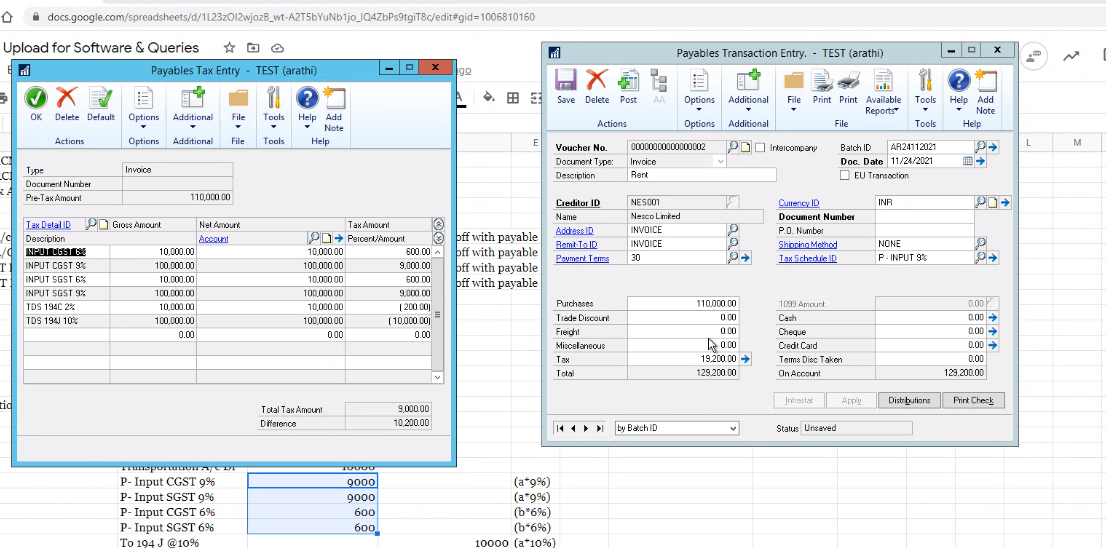

the problem i have at the moment is that on the Header I can only put the full total of 110,000 so then when in the Tax Detail screen i try and split it out as follows but it wont accept the correct amount of tax (which is 19,200)

Can anyone assist with how I can do this transaction in Payables Invoice or do I need to get them to raise it as a Purchase Order so we can separate out the lines?

Thanks in Advance

Laura