Hello all,

I run into the following issue. For a certain reason we had to undo a posted depr journal(28Jan, period 1). We had to use the same voucher series for the reversal so we created a new journal and used the option Function/retrieve posted transactions. So we picked up the posted transactions we wanted and inverted the sign, and we got a reversal. The posting type was still 'depreciation', date the 29th of Jan(period 2).

example:

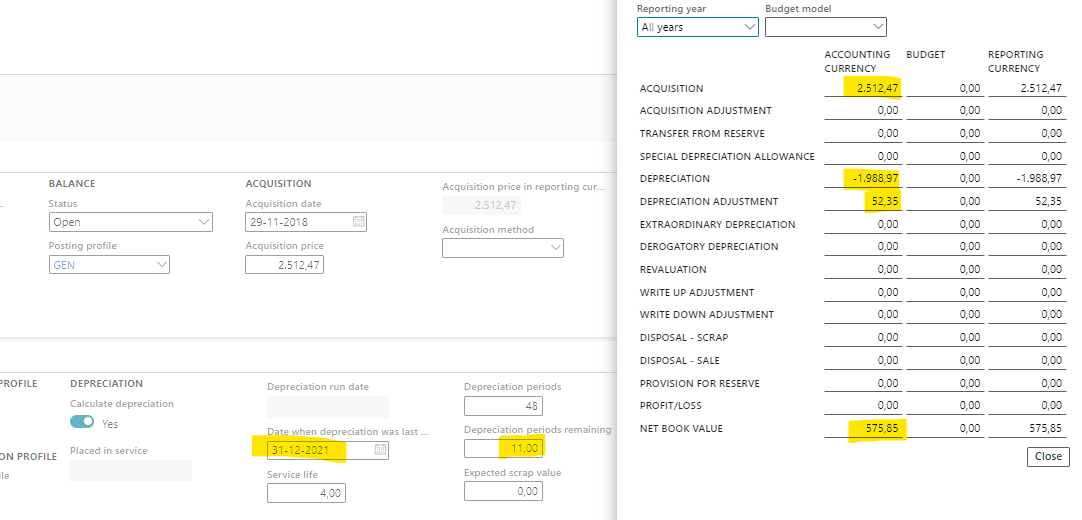

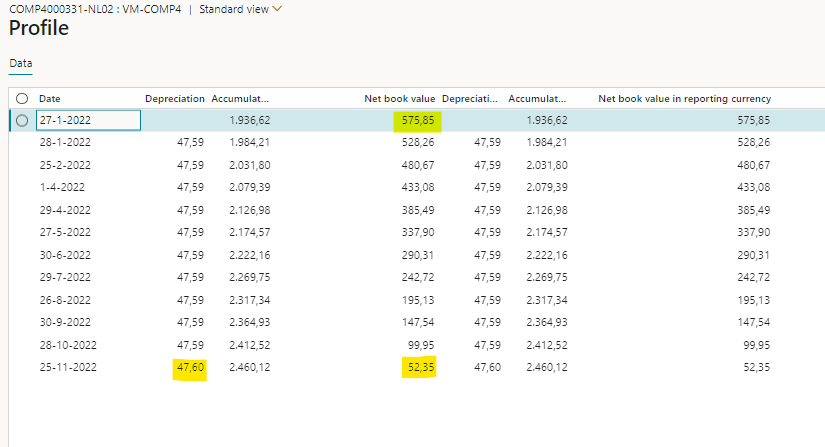

Dec 2021: Asset with Acq value 2512,47, depr till then 1936,62. NBV is 575,85 with remaining periods 11.

Jan 2022: depr made for 52,35. That had to be reversed. So negative depr amount (at credit side)...so in Period 2 we created the reversal.

result: Checking the asset, the NBV was ok, 575,85. Transactions were correctly shown under balances. As we wanted to create a new depr run, we set the last depr run date back to 31dec. as Jan was wrong and the number of periods back to 11. Back to Situation dec 2021

But when we went to the profile menu in the asset, the NBV was still correctly displayed, however the monthly amount was wrong and the number of periods as well. It looks like that the reversal is not taken into account when D365 starts calculating the amounts for the remaing periods, it still thinks it has the NBV from before the reversal..So end Jan.

Anyone experienced this before?

As i thought perhaps it is the posting type, I did another test but then using the depr adjustment as posting type for the reversal, but same issue. in the end, I am missing that month (52,35) which I reversed...although the NBV is correct.

thx,

GJ