1. Setup sales tax code

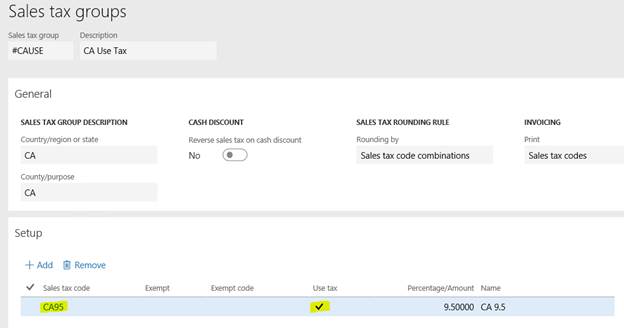

2. Setup sales tax group,

3. Setup item sales group, select item sales group = ‘All’, add sales tax code = CA95

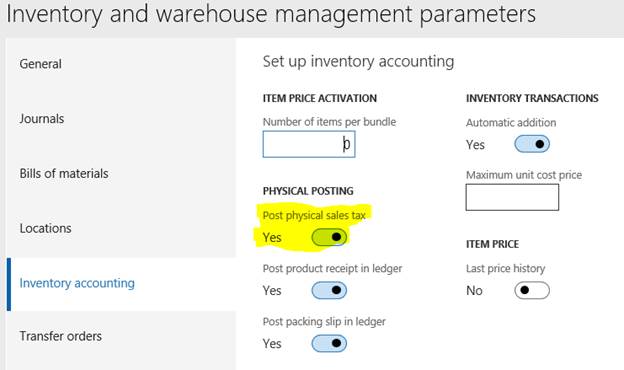

4. Inventory management – Setup – Inventory and warehouse management parameters

Under PHYSICAL POSTING - Post Physical Sales Tax = YES

Post product receipt in ledger = YES

Post packing slip in ledger = YES

5. Inventory management – Posting – Transaction combinations,Activate sales tax group = Yes

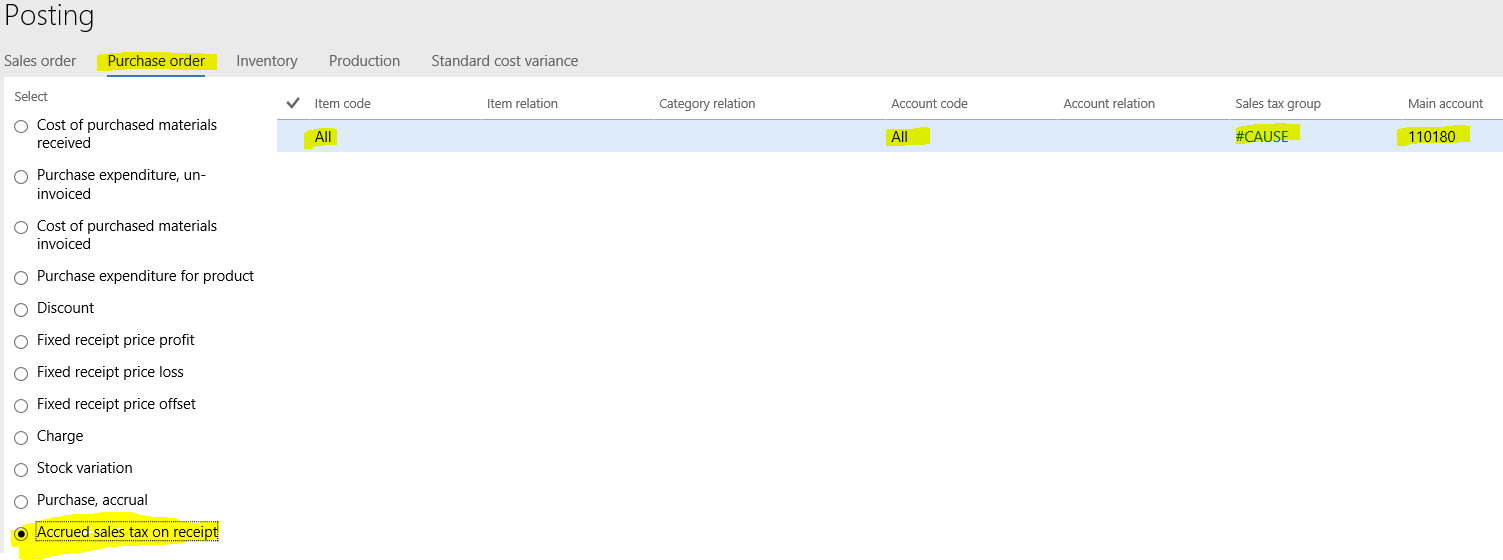

Modules – Inventory management – Posting – Posting

Click on Purchase Order

From the radio button list select Accrued sales tax on receipt

Click on New

Item Code = All

Account code = All

Sales tax group = #CAUSE

Main account = 110180 or select one from the list I used 110180

6. Create PO and header line, Purchase order lines, confirm PO and Post Product receipt Accrued sales tax on receipt

a. Item number = #TestItem

b. Site = 1

c. Warehouse = 11

d. Quantity = 1

e. Unit Price = 1000

f. Expand Line Details

g. Click Setup

h. SALES TAX

i. Item sales tax group = ALL

l. sales tax group = #CAUSE

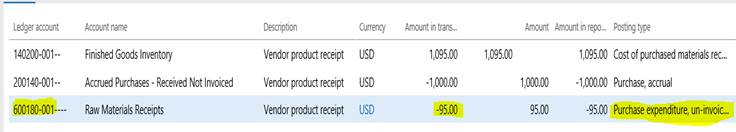

7. The current use tax account 600180 for Purchase expenditure, un-invoiced, why not use 100180 for Accrued sales tax on receipt ?

How to post the Accrued sales tax on receipt ?