Hi CapsLock,

What we've seen most commonly is that the user enters the lease prospectively, meaning entering the remaining payments from the date of migration forward with the commencement date as the day of migration onto the Asset Leasing module.

In your example, I would only enter the line beginning 1/1/2021 and also set the Commencement Date to 1/1/2021. If you were to maintain the commencement date as 1/1/2019, this would cause a few issues. First, the date on the initial recognition journal entry can not be edited so you would have to post this entry in 2019 which is likely closed at this point. Second, if you were to keep the first line of your payment schedule and change the commencement date to 1/1/2021, the system will not allow you to create a lease with a commencement day after any date on the payment schedule.

To record and store the lease's true commencement date, you could enter 1/1/2019 in the Contract Signature Date field for example. This field has no logic behind it and is simply for record keeping purposes.

This approach should calculate and record the liability at its carrying value as of 1/1/2021. However, the right-of-use asset is likely different than your liability on your balance sheet as of 1/1/2021. To account for this, what we've done is calculate the difference between the liability and the carrying value of the asset as of the migration date onto D365. This difference can be inputted into either the Initial direct costs field or Lease incentives field. When creating a lease, any value entered into the Initial direct costs field will increase the right of use asset by that amount. Any value entered into the Lease incentive field will decrease the right-of-use asset by that value.

If you provide your carrying values of the liability, carrying value of your ROU asset, and incremental borrowing rate, I'd be happy to provide the necessary inputs to enter this lease.

I would also like to point out to prevent future errors for other leases, the payment schedule lines that you have shown will likely cause issues. Although for this lease, I would not recommend entering the payment schedule lines to include the payment made in 1/1/2019 as I've described above, I believe this is a good point to make for entering new leases in the future that may contain periods of free rent to help you in the future:

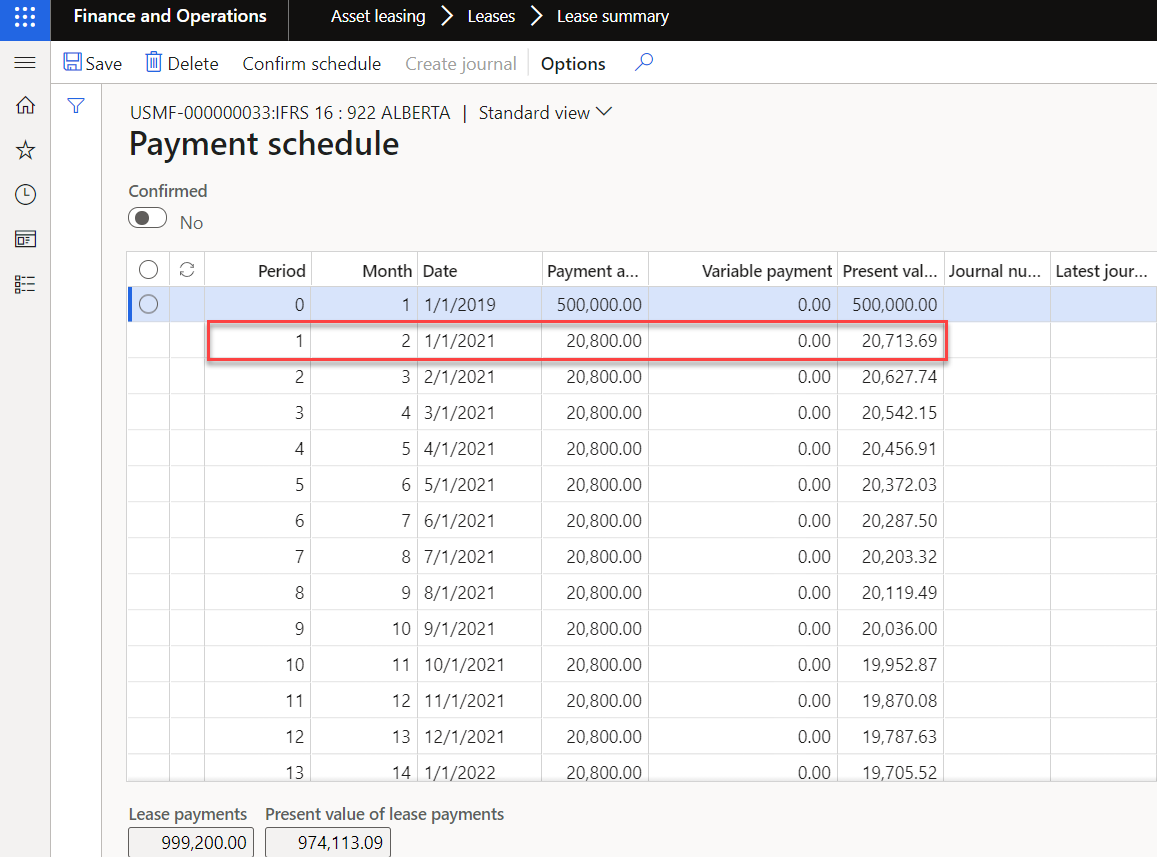

If modifying the Period End Date, the present value of those payments will likely be calculated incorrectly. As a rule of thumb, you should always enter periods of free rent into the payment schedule lines so the system can correctly discount all payments. For example, given your inputs and a rate of 5%, the 2nd payment made on 1/1/2021 is discounted as if it were made in 2/2019 and only discounted 1 period:

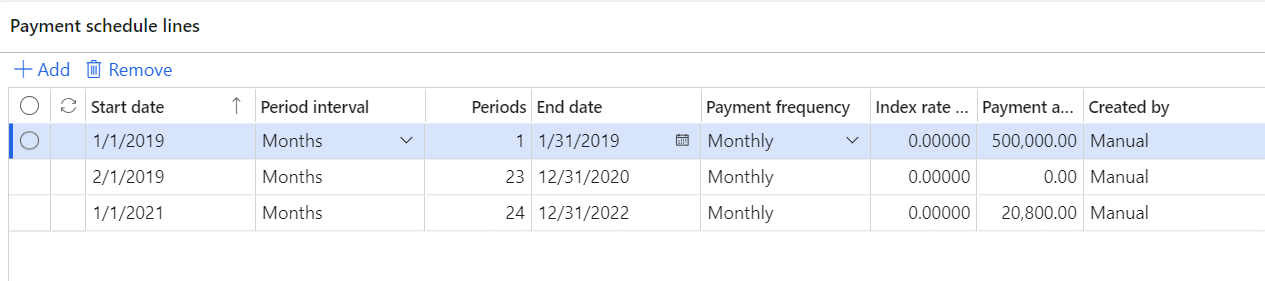

I would enter the payment schedule lines as follows so the system can properly account for the time value of money:

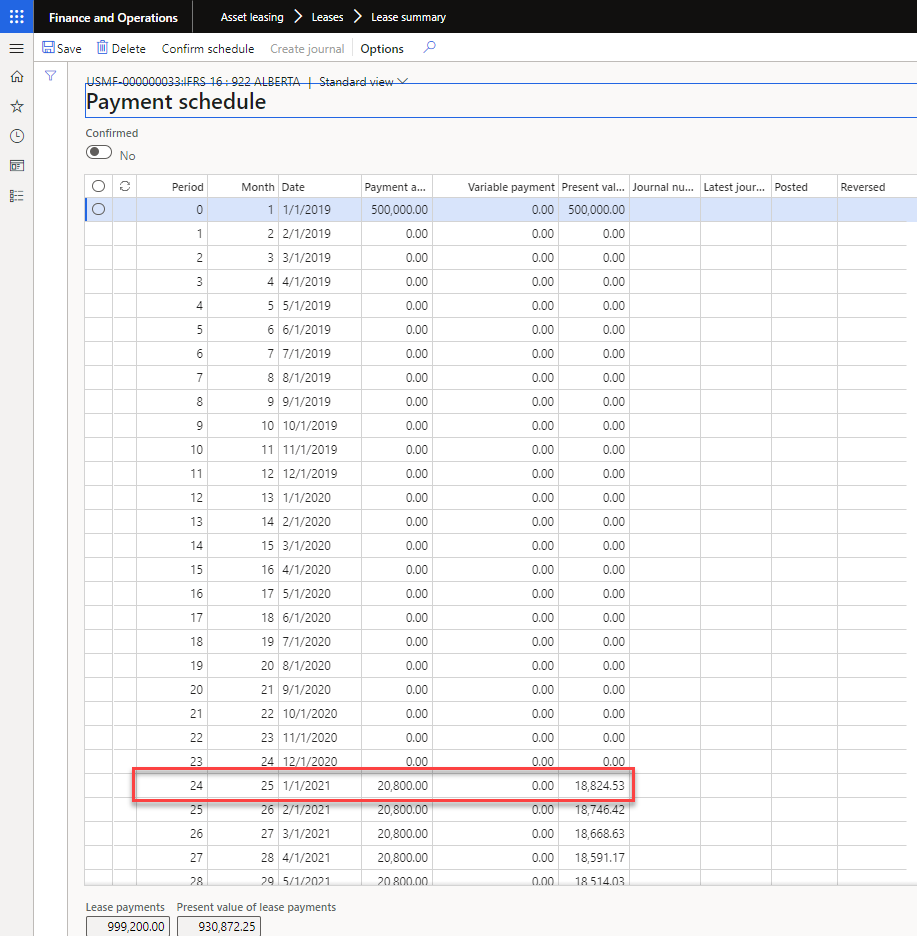

The payment schedule now reflects the passage of time and discounts the payment correctly:

This will have impacts on lease term calculation, the present value calculations, and the liability amortization schedule creation.

Thanks!