Dear Microsoft D365 finance community

I have two questions around fixed assets.

QUESTION 1

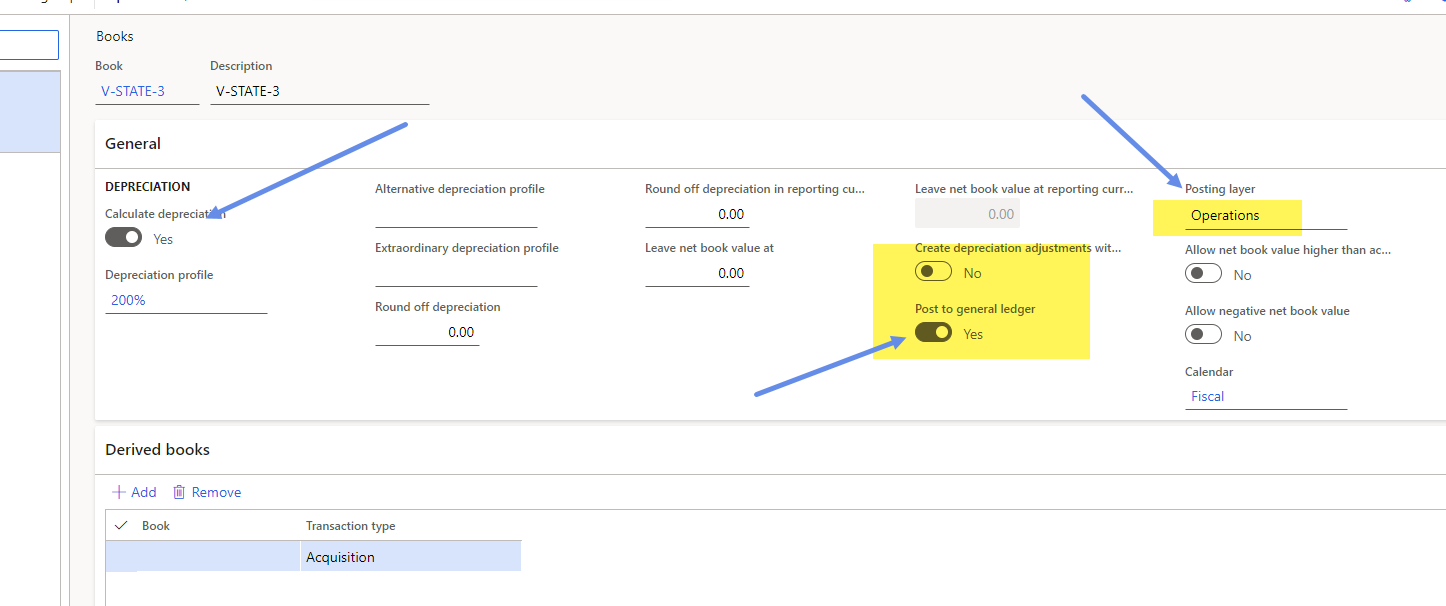

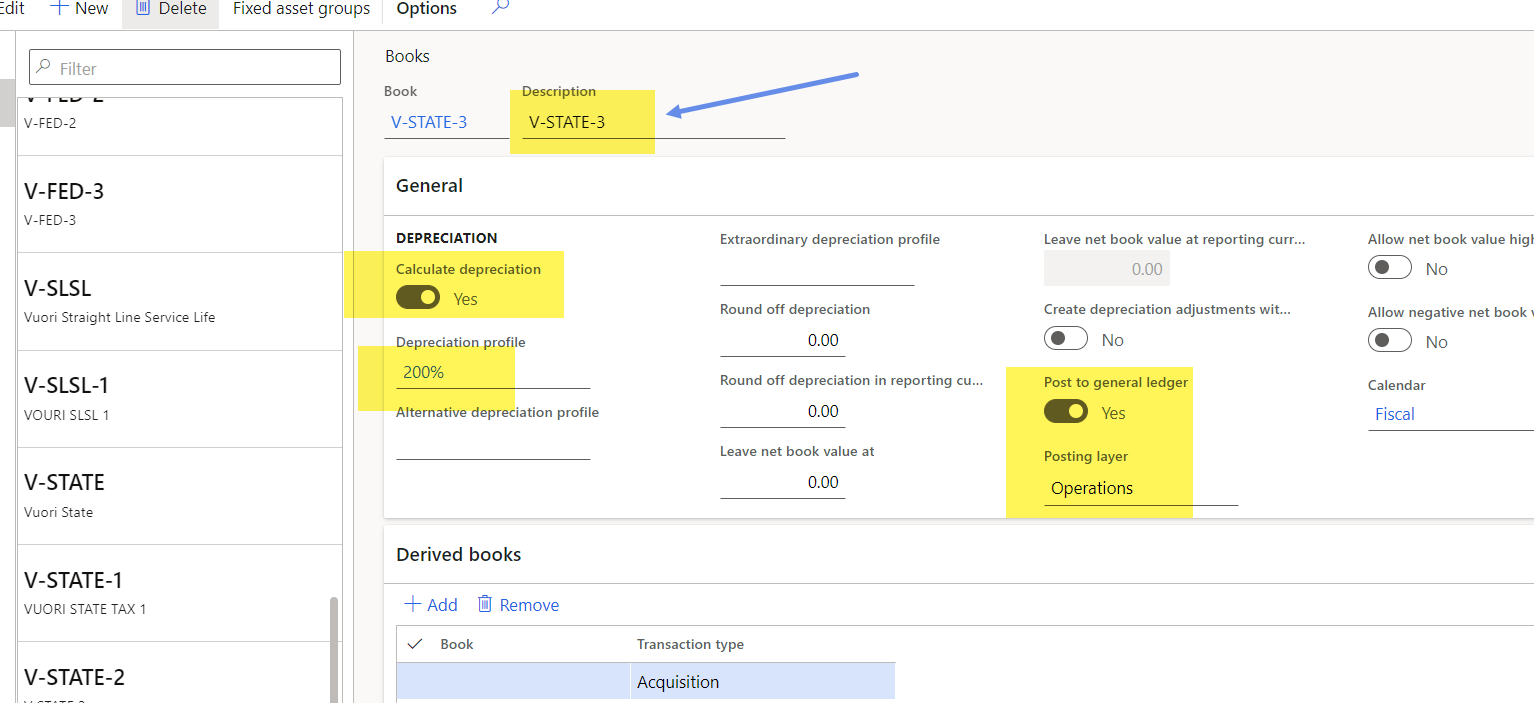

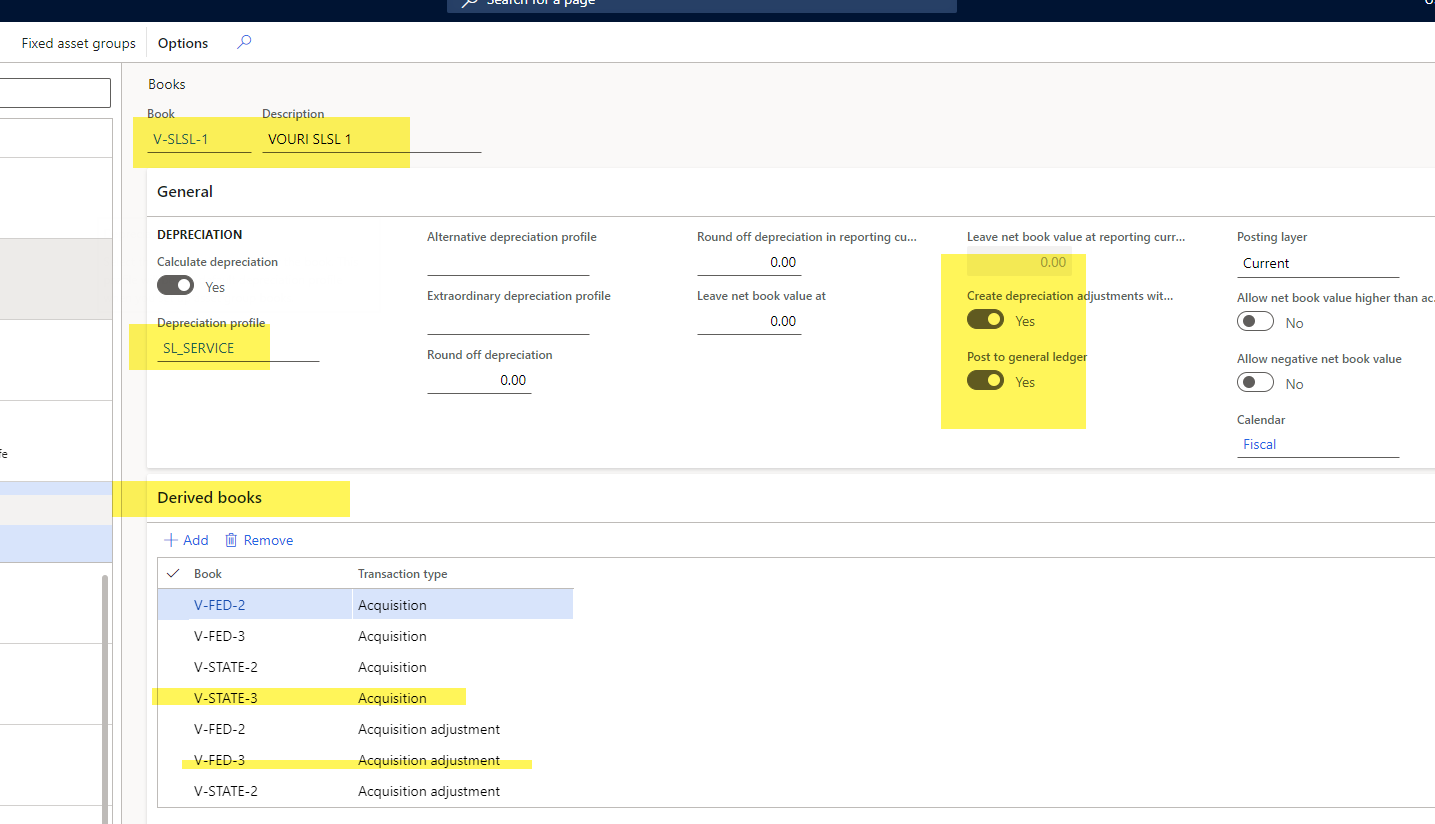

I have created three books one for the GL straight line one for Federal depreciation rates and one for State deprecation rates - please see below for the state and regular GL books.

I have set up the derived books under the Straight line deprecation book.

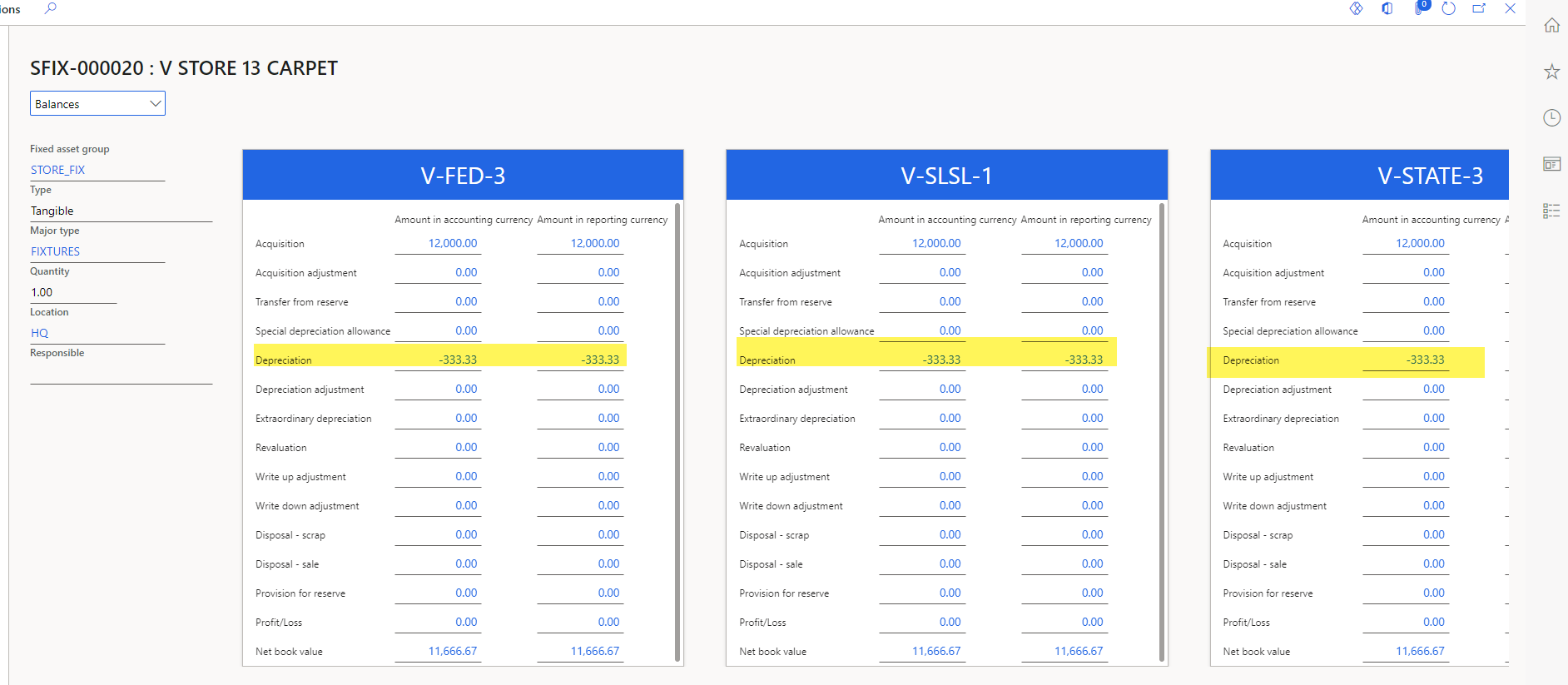

Based on this configuration you can see that the FEDS and STATE books are not calculating deprecation at 200 declining balance. Instead it is at straight line.

Any ideas what I may be doing wrong?

QUESTION 2

Below you can see how I have configured the STATE book. I have set the book to calculate deprecation and I also have it to post to the operating layer.

My question is do I need to post to the GL to get the deprecation to work on the STATE and FED books. I just need to be able to run the fixed asset book compare report to get all the information I need. I do not necessary need it to go to the GL under a different posting layer.

But if I do not set it to post to the GL based on my current config it does not calculate deprecation on the fed and state books.

Thanks very much,