Cash return functionality using Expense management in the Microsoft Dynamics 365 for Operations

Yohann Rolland Axcible

Yohann Rolland Axcible

To complete my previous post, here are details about cash return functionalities. It may happen when a worker has received too much cash advance and needs to return cash to the company. This process has been a little modified in the current version comparing to AX 2012.

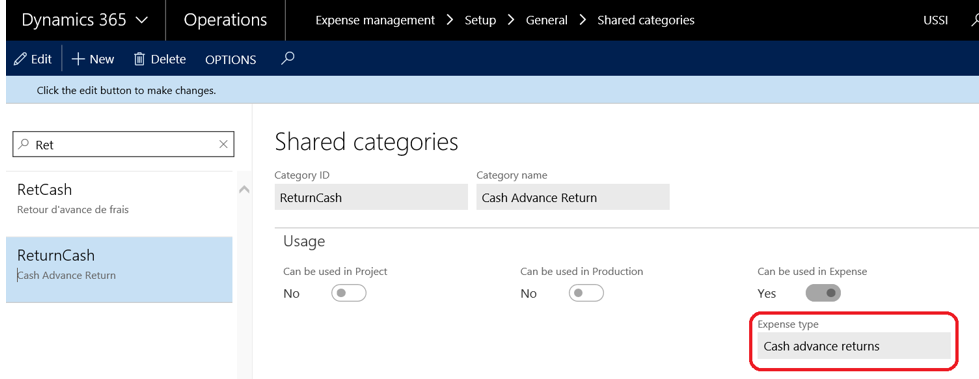

On the shared category, you need to create a new one and affect the “Cash advance returns” value for “Expense type”.

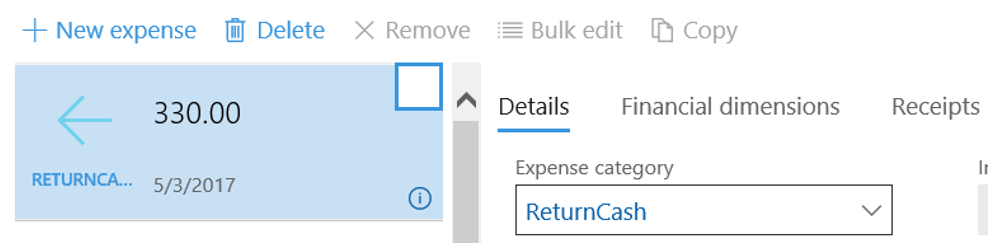

As we did before in the previous post, you can create the expense category from the shared one. Then, when adding an expense line, you will choose the previous expense category just added.

As we did before in the previous post, you can create the expense category from the shared one. Then, when adding an expense line, you will choose the previous expense category just added.

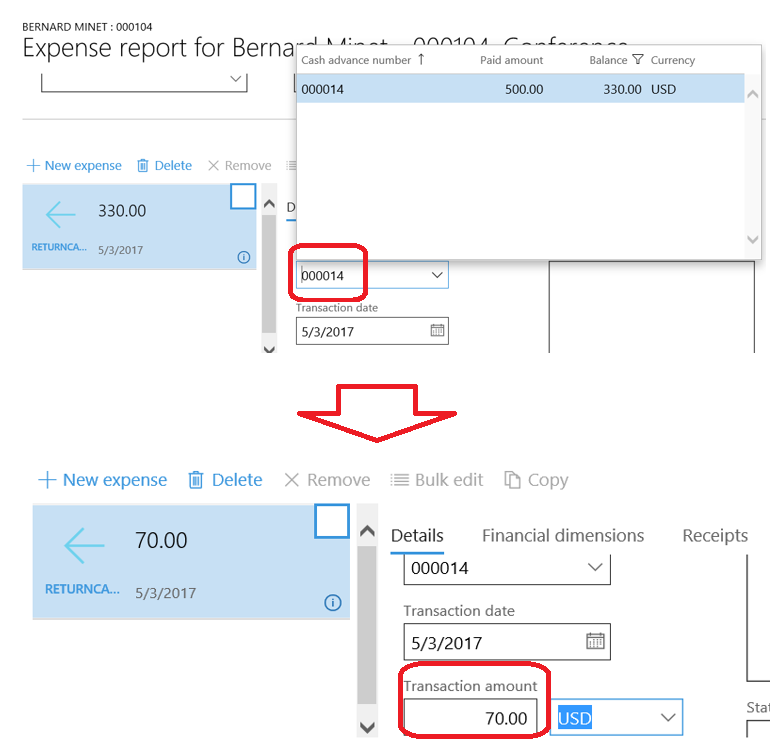

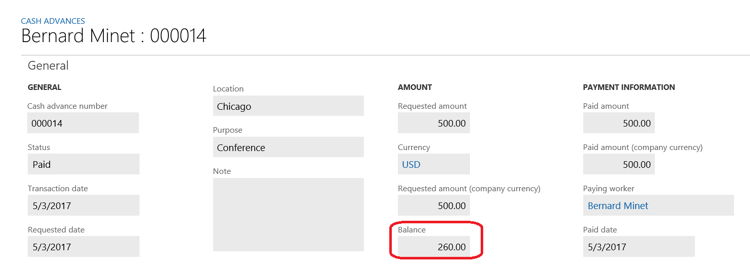

By default, the last cash advance paid by the company is selected in the “Cash advance number” field, but you can choose another if there is any for the current worker. The system default the balance amount for the selected cash advance, but you can manually update it.

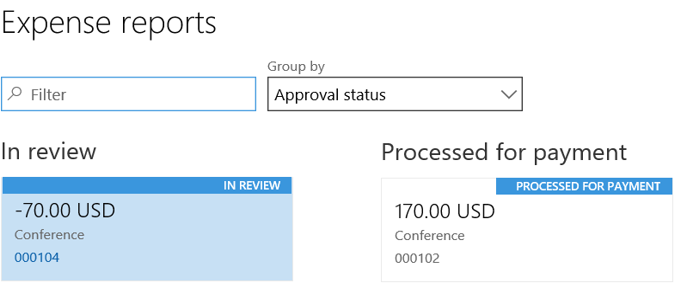

As usual, after submitting the workflow, you will note that the expense report is “in review” for a negative amount.

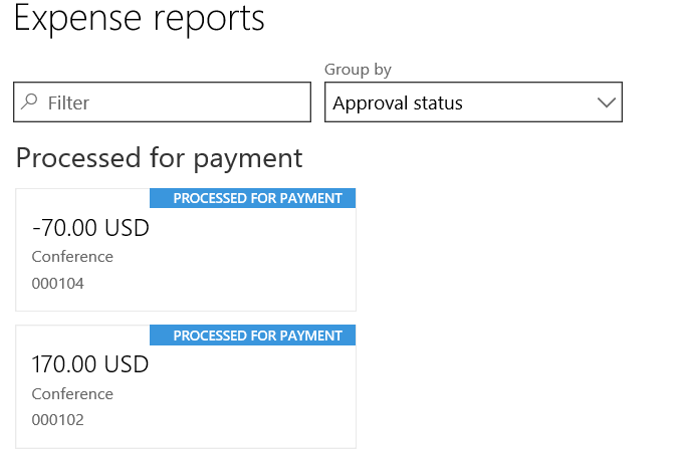

After approving and posting the expense report, the status is updated to “Processed for payment”.

Look at the cash advance balance : the value has been decreased from 500 USD to 260 USD (500 – 170 – 70).

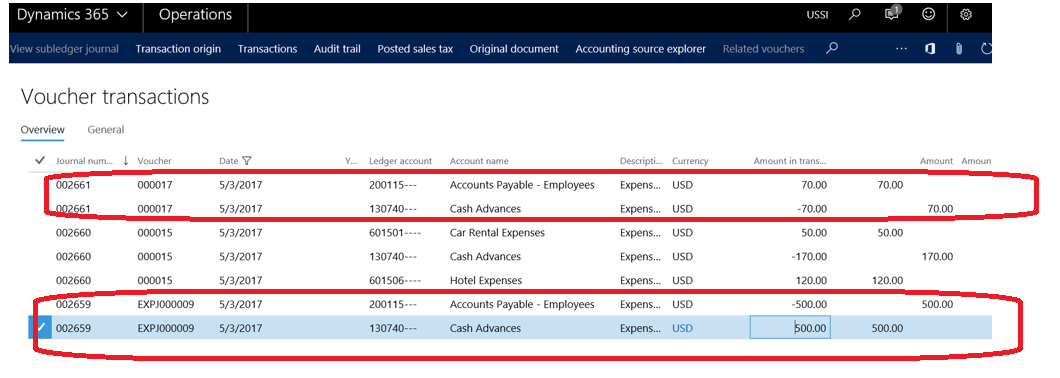

If we see the voucher transactions for this worflow, we can see the 70 USD have been returned to the company (the first cash advance transaction has been reversed for 70 USD).

That’s all !

Yohann ROLLAND

L’article Cash return functionality using Expense management in the Microsoft Dynamics 365 for Operations est apparu en premier sur D365Tour.

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments