Table of Contents

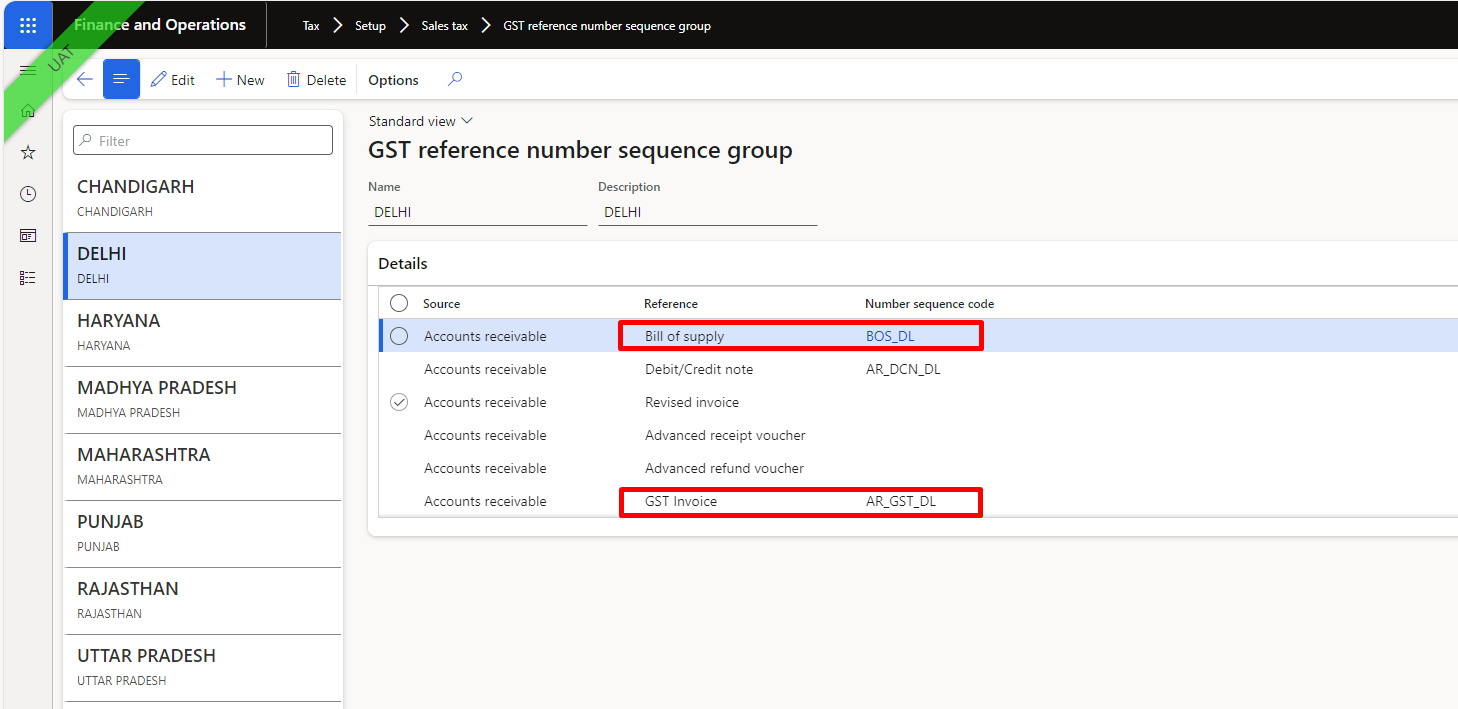

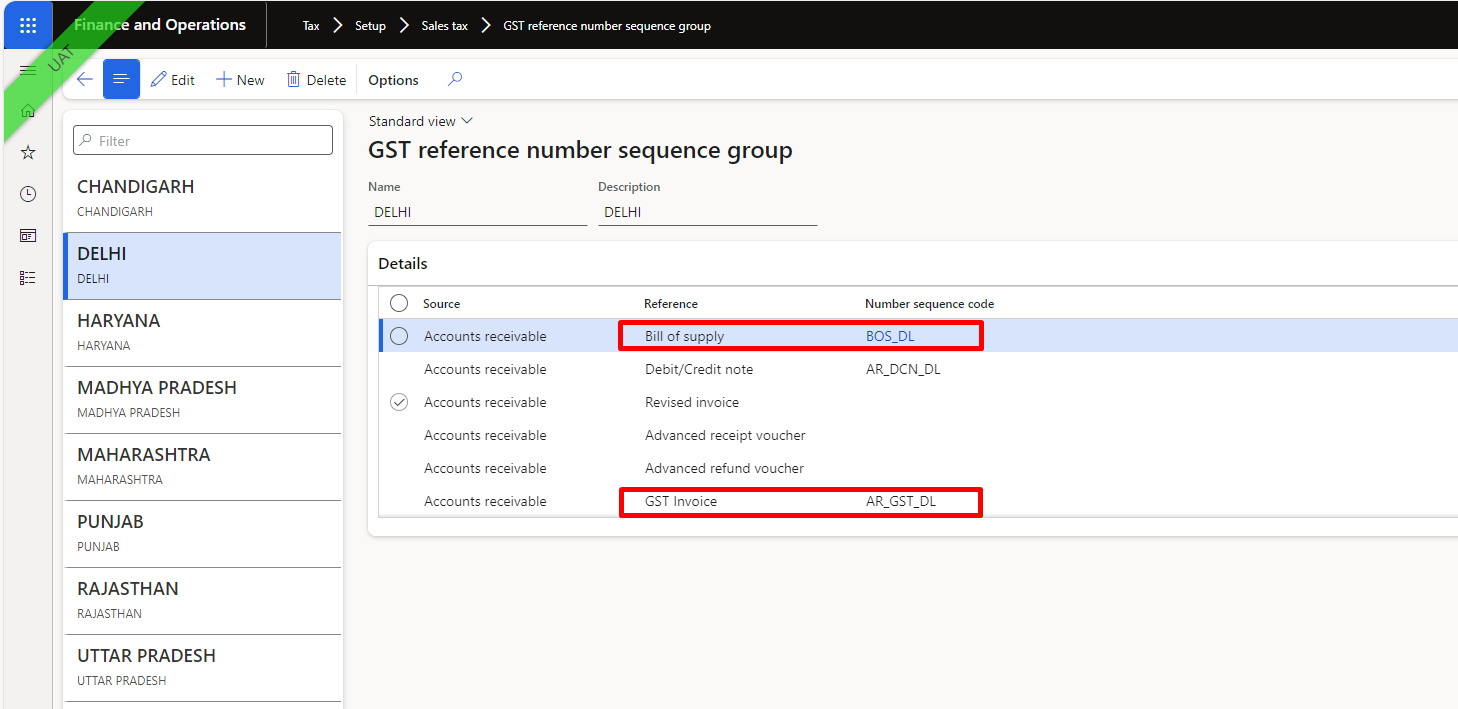

GST reference number sequence group:

Goods and Services Tax (GST) transactions are differentiated by a unique number sequence. If a different number sequence is required for the address of each warehouse or legal entity, you can create a reference number sequence group. You can then assign the reference number sequence group to the addresses.

Navigation - Tax > Setup > Sales tax > India > GST reference number sequence group

Create State wise GST reference Number sequence group for different state based on addresses of legal entity and then created state wise number sequence for Bill of Supply (used for non-GST transaction) and GST Invoice (used for GST transaction for both AP and AR).

Finally map the Created state wise number sequence for BOS and GST invoice with respective GST reference number sequence group as per below SS.

Bill of Supply: The Bill of supply number sequence is used when customer sales that have non-GST transactions are posted

AP GST Invoice: The GST invoice number sequence is used when vendor purchases are posted that have GST transactions together with reverse charge transactions.

AR GST Invoice: The GST invoice number sequence is used when customer sales that have GST transactions are posted.

Important Note for Number sequence in referring to different cases:

- If the tax rate is not zero, the sequence will be picked from the GST tax invoice reference ID.

- If the tax rate is zero (tax rate in every sales order line is zero, exempt, or non-GST), the sequence will be picked from the bill of supply.

- If an item is marked as “Exempted item”, irrespective of a tax rate the sequence will be picked from the bill of supply.

- If an item is marked as “Non-GST” supply, then another tax type is applied on the transaction and the number sequence will be picked from the bill of supply.

Mapping of GST reference number sequence group

Then map the created GST reference number sequence group to each addresses of the legal entity or warehouses respectively.

Application after invoice posting

This configured GST reference number sequence is to be reflected to GSTR report fetched from D365 F&SC as a Invoice Number as per below GSTR1 SS.

Thank You 😊

Happy Learning