Hello Experts,

We have requirement to calculate vendor settlement discount and when discount get calculated, reverse out the sales tax (GST) applicable to that settlement discount.

To achieve that I have created the following set up.

1) On Account Payable parameter

“Calculate settlement for partial payment” and “calculate settlement discount for credit” are selected.

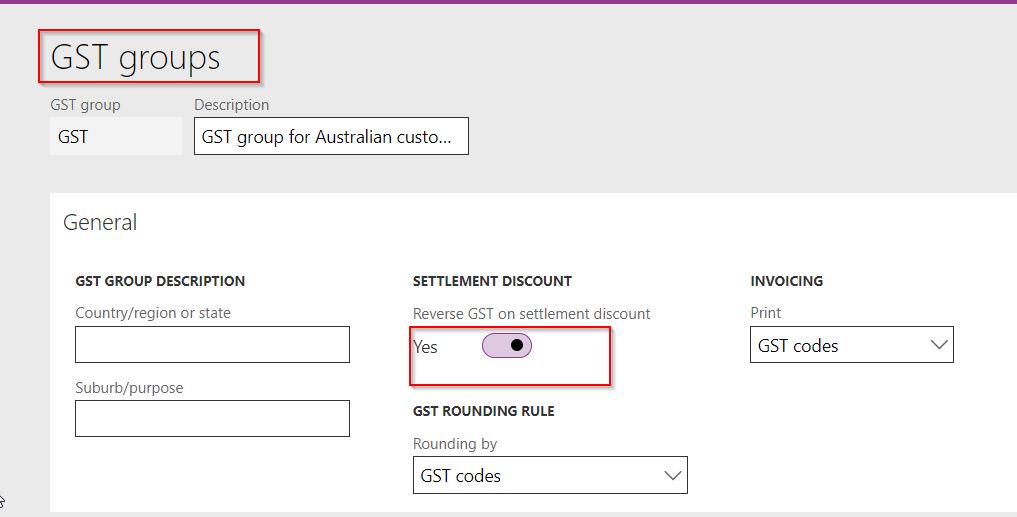

2) Switch on “Reverse Sales Tax (GST)” on Sales Tax (GST) Group

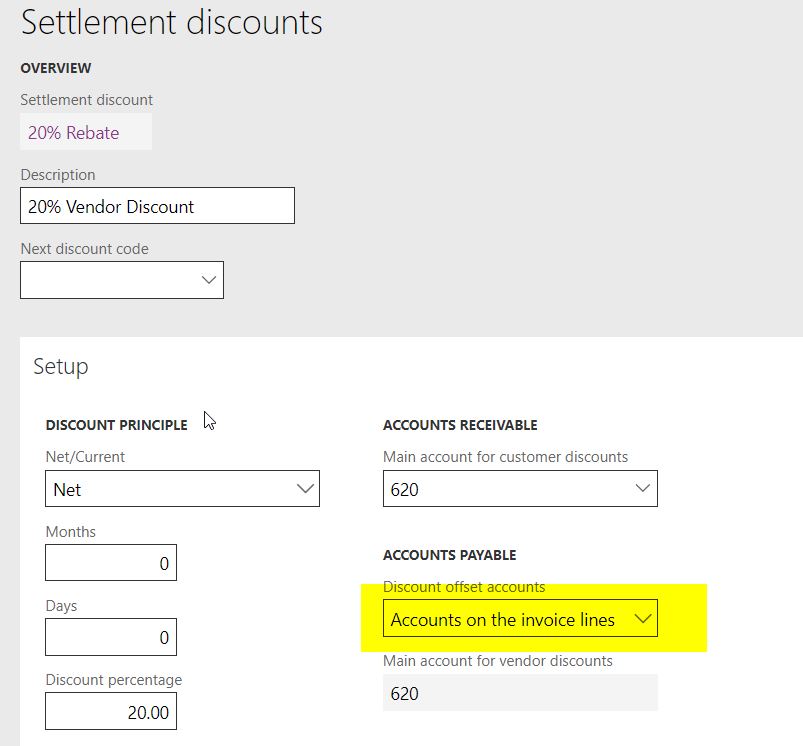

3) Created 20% Settlement Discount Id with “Discount offset accounts” selected to “Accounts on Invoice line” and assign that ID to vendor master.

Now issue is that when I create Vendor payment, system calculates discount correctly using the account used on invoice line however Sales Tax (GST) discount doesn’t get calculated.

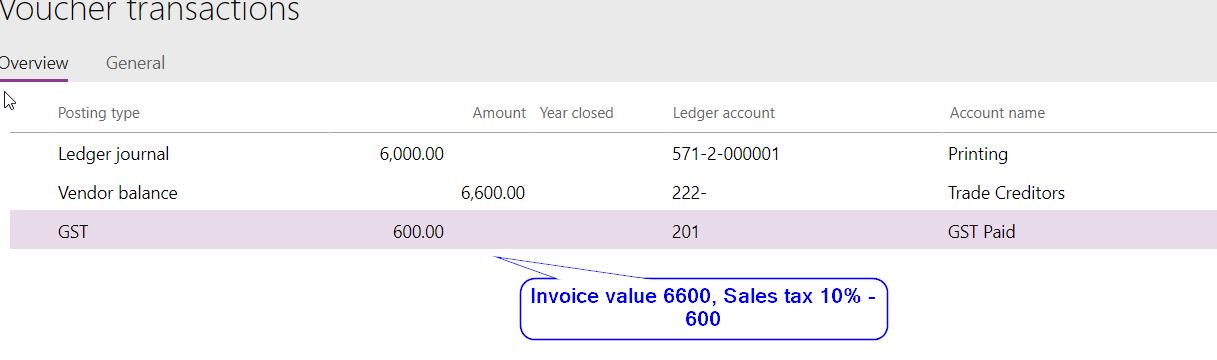

Please see below voucher distribution of invoice, amounted 6600 and sales Tax(GST) 10% -600.

Payment voucher for above invoice with 20% Settlement Discount

Can you please advice if I am missing any set up.

Thanks in advance.