Good afternoon everyone,

We are using D365 product version 10.0.35, platform version update 59.

We are using Exflow for invoice matching and posting in our AP ledger and we are getting the follwing posting errors when this scenario is in play and only affects entries where there is a VAT posting on invoice registration, nil value VAT postings are not affected:- underlying details -

- Currencies - Transaction Currency 1 (T1), Accounting Currency 2 (A1), Reporting Currency 3 (R2) - applies to all combinations i.e. T1 can be GBP, A1 can be SEK and R2 can be EUR - with the real example being -

- Transaction and Accounting Currency are the same = SEK, Reporting Currency = EUR

- Month 8 FX Rates = SEK to EUR = 11.586549176253 / Month 10 FX Rate = SEK to EUR = 11.834022470751

- This can be where differences are at the accounting currency, reporting currency and or both where the transaction currency is different to the accoutuing and reporting currency of the D365 company.

- FX Rates are updated monthly on the last day of each period i.e. Month 8 = 31 Aug 2023.

- FX Revaluations are completed at the AP Sub ledger and General Ledger that encomapss the supplier accounts as well the Balance Sheet accounts used int einvoice regoater posting, as part of each period end close.

- There are no issues experienced in document import however there may be manual adjustment and approval required for invoice line charges not present on source D365 Purchase Order.

- All posting profiles, AP, General Ledger and Exflow parameters appear to be setup as required and there are no customisations to consider other than the Exflow add in.

The issue at hand -

- Invoice register against a supplier matching to a PO by quantity, price and lines, on approval, in Month 8 and posts to Invoice Register, Invoice Offset and VAT accounts in month 8,

- This updates the Supplier sub ledger with the invoice details but does not update the PO as invoiced - this is expected behaviour in our setup, and

- The VAT posting is set at the time of Invoice Register - our company requirements and works as expected.

- The prior ledger periods are updated to On Hold at the end of each month / period end process - therefore Month 8 is now On Hold and no further posting in that period is now possible.

- In Month 10 (but this can be any later period) the approved invoice in Exflow is selected to be posted to complete the automated invoice matching and posting processes that will update the PO for the invoice details, clear down any Uninvoiced Product Receipt posting and ensure the supplier invoice is available for subsequent payment however -

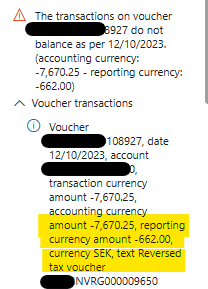

- Where there is a VAT value posted in a prior period and the currency exchange rates have moved, as shown above, the invoice posting is automatically cancelled with the following error message -

You will note the Transaction and Accounting currency values are the same (SEK) with the SEK value in Reporting Currency being 7,670.25 div by 11.586549176 = 662.00 (rounded up) and this is as per the orignal invoice register posting in Month 8.

What is not happening is - the reversal of the invoice registered values at the original rates used in Month 8 to allow for the invoice posting in Month 10 which would show the VAT value as now being 676.38 (rounded up) using the fx rate applicable at the date of the attempted invoice posting.

We can overcome this by cancelling the orignal invoice registration in Exflow and reprocessing in the current period the registration and invoice posting (Month 10) and that works however that is a doubling up on effort for something that ideally is not required as D365 should be able to reverse the original posting in a later period at the original fx rate used where the new fx rate is going to be applied to the base value. However, should and wish for are one thing, and I appreciate that when it comes to posting using fx rates then D365 will usually use the rate applicable at the time of posting but in this matter we have VAT values which complicates matters.

I appreciate that this is my first question on this forum and I may not have posted in the right place or this may not even be a question for the forum considering it is Exflow and not D365 even though they work together and if that is the case I apologise to you all.

I am merely wishing to find out if anyone has come accross this issue in the past and found or been able to advise a solution or if not then from your knowledge are there any matters I shoudl be mindful of in the D365 setup where this can arise, without using an add in such as Exflow, that I can review and test out before going back to Exflow when I can be reasonably sure that it is not a standard D365 issue but the add in that is dirving the errors. By doing this I hope to expedite a solution and avoid the usual back and forth that you can get between partners and third party suppliers that not only wastes time but also money and in the process could transfer knowledge in house to be better able to administer our systems ourselves. Ultimately this needs to be resolved as it has been going on for over 12 months, since going live, and if there is any assitance or comments that you can provide then I will be very grateful to receive them.

Thank you for your time in reviewing this rather long brief and will look forward to hopefully receiving some replies in the near future.