Party postal address sales tax group V2

Guy Terry

Guy Terry

In Dynamics 365 F&O, if you want to import addresses which have a Sales tax group, you will probably need to use the Party postal address sales tax group V2 data entity. (And if you are importing addresses but DON’T need to set a sales tax group, you will probably use a different data entity).

Here is an address on which the Sales tax group has been set:

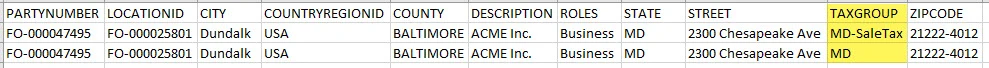

Normally, when I am setting out to import something using a data entity, I will first export that data entity (with Select fields set to Importable fields). Here is that address after it has been exported to Excel:

We can see that it has a TAXGROUP, but why does it appear on two rows?!

The reason is, although addresses are stored in the Global Address Book, the Sales tax group of an address is stored at the Legal entity level….. and this address has a Sales tax group configured in two Legal entities. (To see the Legal entity in the exported data, you need to have Select fields set to All fields).

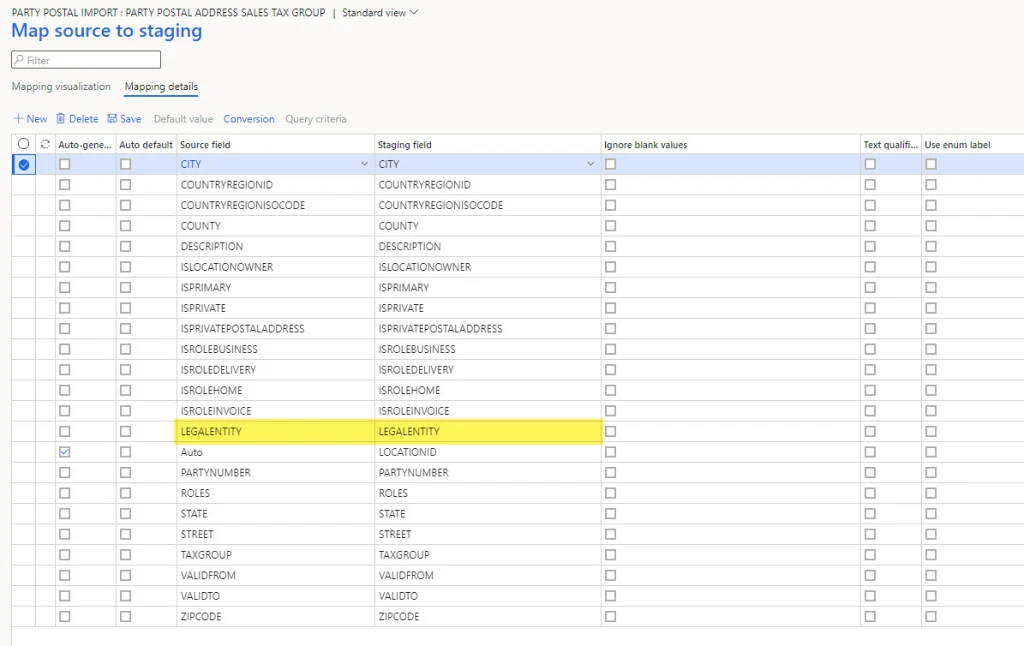

This means that if you want to import addresses which have a Sales tax group using the Party postal address sales tax group V2 data entity, you need to include a field called LEGALENTITY in the source data.

And if you want to set the Sale tax group on an address in multiple Legal entities, you will need to include that address on multiple lines in your import (each line having a different LEGALENTITY).

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments